Wednesday, December 31, 2008

Stunning, But Not Surprising

The Fed, um, did a very groundbreaking, um, study (Bloomberg article):

I did my study on the topic long ago, and here's a link to my presentation of results.

Attempts to loosen terms on hundreds of thousands of delinquent home loans may be hindered by so- called piggyback second mortgages that gained popularity during the U.S. housing boom, Federal Reserve researchers said.What a shock!! Next, they'll do a study on whether lower interest rates cause mortgages to be more affordable, and solemnly conclude that it doesn't work for negative amortization mortgages that recast. It's times like these when Tanta's loss bites the hardest. I can only imagine her eloquent sputterings on this, um, research.

Most of the piggyback loans, often used in place of down payments or mortgage insurance, are held by lenders different from the holders of the home loans, making it more difficult to secure approval needed for modifications, according to the study published in the December Federal Reserve Bulletin.

I did my study on the topic long ago, and here's a link to my presentation of results.

Sunday, December 28, 2008

Perhaps If The UN Got Excited When 50 Shells Fell On Israel....

There's a lesson for us all in this.

I see this morning that the UN released a statement asking for an end to all violence between Gaza and Israel, prompted by Israel's reprisal which has now killed over 200 people in Gaza. It might have worked better if they had released such a statement earlier, when Hamas was launching numerous rocket attacks each day against Israel.

Since one can read most news outlets and get no idea of the scope of the attacks against Israel, here are the "rocket calendars" of such attacks from Elder of Ziyon. Look at that link, and then look at the December calendar: (see links for explanation of the coding)

Israel responded to a level of attack to which any country would have to respond. You simply cannot sit around and let this level of shelling of your border towns each day persist while doing nothing other than praying for G_d to help you out. Hamas provoked this deliberately. First Israel tried all other measures, including trying to shut down flow of weaponry into Gaza, etc.

If the "international community" cares about the plight of the Palestinian population in Gaza, it had better start getting antsy before Israel is forced to these measures rather than after. The escalation began in November - on November 5th there were over 100 mortars and rockets launched from Gaza into Israel.

Israel is rather more patient than the US population of say, Buffalo, would be.

Confederate Yankee has two germane posts up, and he may well be right about Hamas having groups of fighters in position. One thing's for sure - Hamas did this deliberately. Even the BBC covers it: Hamas prevents the injured from aid by Egypt. The world should not lift a finger to help Hamas, because it will cause more deaths in the end if we do.

SC&A predicted this disaster when Israel cleared out of Gaza, and it has come to pass. This is tragic, but involvement in tragedy doesn't imply guilt for it. In part two of his series Progress and Failure, SC&A writes:

I see this morning that the UN released a statement asking for an end to all violence between Gaza and Israel, prompted by Israel's reprisal which has now killed over 200 people in Gaza. It might have worked better if they had released such a statement earlier, when Hamas was launching numerous rocket attacks each day against Israel.

Since one can read most news outlets and get no idea of the scope of the attacks against Israel, here are the "rocket calendars" of such attacks from Elder of Ziyon. Look at that link, and then look at the December calendar: (see links for explanation of the coding)

December 2008

| Su | Mo | Tu | We | Th | Fr | Sa |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 1Q | 3M 2Q (23M) | 3Q 15M | 1Q 2M | 2Q (7M) | 3Q (20M) | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 7Q 1QS | 1QS | 1M | 1Q | 2Q 1QS (2M) | 1Q 3M | |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 1Q 3M | 1Q | 8Q | 24Q 1M | 8Q 2QS | 3Q | 15Q 26M 1QS |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 17Q 3M 1QS | 3Q 1QS | 8Q 8M (1P) | 41Q 24M (54M) | 7Q 7M | 25M 1QS (2F) 2MS | 64Q (1F) 16M |

| 28 | 29 | 30 | 31 | |||

| 14Q (5G) | ||||||

Israel responded to a level of attack to which any country would have to respond. You simply cannot sit around and let this level of shelling of your border towns each day persist while doing nothing other than praying for G_d to help you out. Hamas provoked this deliberately. First Israel tried all other measures, including trying to shut down flow of weaponry into Gaza, etc.

If the "international community" cares about the plight of the Palestinian population in Gaza, it had better start getting antsy before Israel is forced to these measures rather than after. The escalation began in November - on November 5th there were over 100 mortars and rockets launched from Gaza into Israel.

Israel is rather more patient than the US population of say, Buffalo, would be.

Confederate Yankee has two germane posts up, and he may well be right about Hamas having groups of fighters in position. One thing's for sure - Hamas did this deliberately. Even the BBC covers it: Hamas prevents the injured from aid by Egypt. The world should not lift a finger to help Hamas, because it will cause more deaths in the end if we do.

SC&A predicted this disaster when Israel cleared out of Gaza, and it has come to pass. This is tragic, but involvement in tragedy doesn't imply guilt for it. In part two of his series Progress and Failure, SC&A writes:

The Middle East is the canvas on which we can clearly see the kind of heroes the different societies produce and why. In most of the Arab world, it is the primal id demands that are most influential, yielding the most vicious kinds of ‘heroes,’ to the exclusion of almost everything else. Israel is a society that produces heroes of an altogether different sort. Israel is at the fore in providing aid, medical treatment and emergency assistance of all kinds, all over the globe.This is a mess which more pretension will not ameliorate. I think Hamas took over Gaza and cannot create a workable government, and thus is forced to create such situations to prevent its own failure. They seem to be using the population of Gaza as hostages. Some are willing hostages, but still.

The heroes of a progressive culture and society retreat from conflict whenever possible. Real heroes engage in conflict when necessary to preserve the safety and well being of their community. The heroes of broken and regressive societies seek conflict, real or imagined, to fend off progress and to promote dysfunction and hate.

Saturday, December 27, 2008

On The Lighter Side

A true advance in energy conservation, brought to you by the IPCC:

Hat tip: comments at Anthony Watts'.

I scanned this Calvin & Hobbes cartoon in from Watson's collection Homocidal Psycho Jungle Cat. The copyright is 1994, but it is all too appropriate at this time. Click for a larger image.

Personally, I think we should all include this image in emails to Congress regarding the Big 3 bailout. Bill Watson - a prophet.

Buy all the Calvin & Hobbes books. It's, it's, it's the way to create 2 million green jobs!!!

I haven't been paying any attention to the Caroline Kennedy bit, because I'm not from New York. Still, several parts of this interview made me twitch. Transcript. No one's going to call her a bimbo, but if she and Palin were running in a bimbo competition, I know who would win the bimbo title at my house:

Hat tip: comments at Anthony Watts'.

I scanned this Calvin & Hobbes cartoon in from Watson's collection Homocidal Psycho Jungle Cat. The copyright is 1994, but it is all too appropriate at this time. Click for a larger image.

Personally, I think we should all include this image in emails to Congress regarding the Big 3 bailout. Bill Watson - a prophet.

Buy all the Calvin & Hobbes books. It's, it's, it's the way to create 2 million green jobs!!!

I haven't been paying any attention to the Caroline Kennedy bit, because I'm not from New York. Still, several parts of this interview made me twitch. Transcript. No one's going to call her a bimbo, but if she and Palin were running in a bimbo competition, I know who would win the bimbo title at my house:

Caroline Kennedy: People really do ask me anywhere I go are asking me if I’m going to run for office one day so but all of a sudden maybe that day is now because I think it’s a crisis we are facing and I think I have brought a lot to the efforts to the schools and I’ve think I’ve my spent my life as a mother, (working for the New York City public schools) writing books on the constitution, writing books about courage, trying to get people involved in service and in their communities and maybe I should do the same thing. While I was thinking about it in my own head, and in my heart, talking to my children and my husband, ya know people started coming up to me and saying ‘Why don’t you be senator you’d be great’, ‘Go for it’, ‘We’re rooting for you’.. on the subway this morning people were coming up to me, somebody dropped off two hundred signs three weeks ago at my husbands office before I even thought this was real. …I know I really need to be able to put that kind of enthusiasm and energy and opportunity to work for the people of New York. I would love to do that because this is my homeBut maybe she is the best pick - who knows, maybe the others are all corrupt. I kind of laughed when she mentioned the federal stimulus and making sure that NY gets its share. She's dismayed by her own voting record.

...

Dominic Carter: Caroline when we talk to New Yorkers many of them have a lot of good things to say about you. Some of the criticism we’ve heard, and you heard over the past couple of days, some people may have a sense of feeling that there’s a sense of entitlement as it relates to you possibly going to the senate. How do you respond to that criticism?

Caroline Kennedy: It’s not a way I’ve ever lived my life I know people have a lot opinions about our family, good opinions, bad opinions, in our family, my family. I can tell you in our family in particular there is a sense we have to work twice as hard - people have this perception - and we are fortunate but I think it’s a question what you do with that opportunity.

Wednesday, December 24, 2008

Merry Christmas! Happy Holidays! Happy Hanukkah!

Peace on earth and goodwill to man! (A sentiment that works for persons of all ethnic backgrounds and faiths).

I don't feel like writing about economics today. Instead, let's have a few entertaining Scrooges along the lines of red and green:

GREEN: I laughed so hard over Anthony Watt's post on CSIRO's (Aussie scientists) warning that Christmas lights are gonna kill the world. The comments are funny; two of the best:

Read about the history of Hanukkah. It's all about keeping the lights on, and somehow the story of the Temple being seized and converted to worship of a false God, the rebellion, and the reconsecration of the Temple to its proper use seems incredibly appropriate to our current scientific culture.

Of course, I cannot end this post without a link to Iowahawk's classic post Top Scientists Warn: Sea Gods Angry.

May the small, beleaguered lights of truth not stop burning in man's hearts during my lifetime. I don't think we can achieve Peace on Earth, Goodwill To Man without those lights.

I wish you all a joyous time with friends and family over these holidays, and for those laboring under grief, may the eternal and sacred light lift your darkness.

I don't feel like writing about economics today. Instead, let's have a few entertaining Scrooges along the lines of red and green:

GREEN: I laughed so hard over Anthony Watt's post on CSIRO's (Aussie scientists) warning that Christmas lights are gonna kill the world. The comments are funny; two of the best:

“SCIENTISTS have warned that Christmas lights are bad for the planet due to huge electricity waste and urged people to get energy efficient festive bulbs.”and

…and they want us to use plug-in electric cars…?

Must be grant application time again.

The Australian CSIRO (Commonwealth Scientific Research Organisation) was once a very well respected Government financed institution.RED: The coyote is howling lonesomely in the desert over the increased electricity prices he is going to pay next year. The reason? A program that places a hefty tariff on electricity prices to fund green energy, thus causing red numbers on businesses' balance sheets:

The finance has been gradually reduced for years and years, During the funding reducing periods many employees and researchers were fearful of their livelihood.

And then came AGW and a new lease of life.

There are some very committed researchers and scientists at the CSIRO - and you can take that to mean ambiguity

Nothing says “jobs creation” like increasing electricity prices. Note that these prices are “per meter.” Since many businesses have many meters (we have nearly 100 in Arizona), the price increase is much higher. For example, we expect to see a $2-$5 thousand dollar increase next year from this program.He then goes on to look at just how well wind energy is working in Texas, linking to Gilberson:

A power producer typically gets paid for the power it generates. In Texas, some wind energy generators are paying to have someone take power off their hands.So the government pays the wind power producers to produce energy at the wrong time, and they pay enough that the wind power producers pay utilities to take the power in order to make their profit from the difference. You, of course, pay the government to pay the wind producers to pay the utilities to take the power off their hands. Not a way to save the planet or the economy, is it?

Because of intense competition, the way wind tax credits work, the location of the wind farms and the fact that the wind often blows at night, wind farms in Texas are generating power they can’t sell. To get rid of it, they are paying the state’s main grid operator to accept it. $40 a megawatt hour is roughly the going rate.

Read about the history of Hanukkah. It's all about keeping the lights on, and somehow the story of the Temple being seized and converted to worship of a false God, the rebellion, and the reconsecration of the Temple to its proper use seems incredibly appropriate to our current scientific culture.

Of course, I cannot end this post without a link to Iowahawk's classic post Top Scientists Warn: Sea Gods Angry.

May the small, beleaguered lights of truth not stop burning in man's hearts during my lifetime. I don't think we can achieve Peace on Earth, Goodwill To Man without those lights.

I wish you all a joyous time with friends and family over these holidays, and for those laboring under grief, may the eternal and sacred light lift your darkness.

Tuesday, December 23, 2008

More Holiday Cheer

Long time readers of the blog remember my obsession with freight and port traffic last year. Bloomberg has a pretty good article up on the topic now:

West Coast port traffic slowed earlier and harder than the ports on the eastern seaboard, but now all of it is slowing very obviously.

Several countries are trying to set up trade financing by government bank or quasi-government credit. I found this article on more Chinese reg changes interesting:

The whole Merckle saga still has not been resolved. Is he going to end up being the Donald Trump of Germany?

I know the average individual doesn't deal much with commercial credit. Perhaps this article on Indian companies seeking financing to cover US automaker orders will offer some perspective:

The US auto companies do business on a JIT basis and control their costs by forcing suppliers to absorb the impact of holding inventory and carrying those intermediate costs.

September and October are typically Long Beach’s busiest months as U.S. retailers take deliveries for holiday sales. This year, imports fell 15.8 percent from a year earlier in September, 9.5 percent in October and 13.6 percent in November.I don't write much about stuff like this once it's happened, because my focus is far ahead. If it's not old news to me by the time something like this hits Bloomberg, then I screwed up (which happens often enough). Risk analysis is not meant for perfection; it's a tool to come out ahead of the game years down the road. It does work better than charging blithely ahead into disaster. You cannot compensate well for bad loans after they are written, which is why we are seeing so much pain, angst and losses now.

...

The Baltic Dry Index, a measure of shipping costs for commodities, is down 93 percent from a record in May, a sign that traders expect export volumes to stay depressed.

Slowing trade is both a cause and an effect of the first simultaneous contraction in the world’s largest economies since World War II.

At the adjacent ports of Long Beach and Los Angeles, together the largest in the U.S., trade has slowed about 10 percent this year, a record drop. In 2007, volumes slid for the first time in more than a quarter century.

West Coast port traffic slowed earlier and harder than the ports on the eastern seaboard, but now all of it is slowing very obviously.

Several countries are trying to set up trade financing by government bank or quasi-government credit. I found this article on more Chinese reg changes interesting:

China will loosen regulations on the prepayments companies can receive when exporting goods to help their cashflow as the global financial crisis hits overseas sales, the State Administration of Foreign Exchange said today.Same for importers.

Companies will be allowed to collect 25 percent of prepayments on exports in foreign currency, up from 10 percent, starting from today, the regulator said on its Web site.

The whole Merckle saga still has not been resolved. Is he going to end up being the Donald Trump of Germany?

I know the average individual doesn't deal much with commercial credit. Perhaps this article on Indian companies seeking financing to cover US automaker orders will offer some perspective:

It is estimated that around 50 component makers from India supply directly to the three auto companies or their Tier 1 suppliers and the annual shipments are close to $1 billion. "It is a very difficult situation for exporters to the north American market. Not only banks are reluctant to provide credit, risk insurance companies are also not very forthcoming in supporting such deals," Vishnu Mathur, executive director of Automotive Component Manufacturers Association (ACMA), told TOI.So these businesses are approaching their government to try to get financing for working capital. This is why cash-strapped companies or companies that have experienced rapid expansion are hit so hard in a credit crunch. They may have orders, but they may not be able to get financing to produce those orders. They then can lose out to a company which is able to provide its own financing.

The US auto companies do business on a JIT basis and control their costs by forcing suppliers to absorb the impact of holding inventory and carrying those intermediate costs.

Monday, December 22, 2008

Not Precisely Conducive To Holiday Spirits

I'll get back to cars and gas taxes, but first, a brief global interlude.

In 2009 world trade is going to contract. We just don't know by how much. Here's a gander on some of the key Asian stats:

Japan: November trade stats announced under the headline "Kablooey":

Of course that was a fallacy because about 1/3rd of Chinese GDP is based on exports, and a hefty chunk of those exports go to the west.

Chinese exports and imports also fell:

The big drop in imports should not surprise anyone; China's housing market is contracting (Jan to Nov housing sales were down 18.8%) and the government's plans to stop more employment cuts in the state-owned enterprises include plans to buy stockpiles of metal, etc from domestic operators. China will try to stimulate its economy, but the corollary is that its imports will drop relative to exports. Trade with India has been one of China's bright spots, but....

We don't have November data for India, but in October exports were down 12% and industrial production declined slightly, and in November excise taxes were down about 15%. The auto business is impacted:

Not surprisingly, Malaysian exports dropped in October. Singapore November non-oil exports dropped over 17% on a YoY basis. Thailand's November exports dropped over 18% on a YoY basis.

Indonesia is seeing the weakening too, and the attempt in this article to slot in expectations for 2009 was interesting:

The rapid rise in lending to eastern European and some ME economies is going to snap back with a vengeance as the eastern European slump keeps building: Czech industrial output fell 8.7% YoY in October, Hungarian industrial output fell 7.2% YoY in October, and Polish industrial output fell 8.9% in November. These were the stronger eastern European economies. There is not much near-term hope for them; October German industrial output fell 3.8% on a YoY basis, October French industrial output fell 6.9% YoY, October Italian industrial output fell 6.9% YoY, October Spanish industrial output fell 12.8% YoY, European new car sales dropped by 25% in November, and European industrial output declined 5.3% YoY in October.

Needless to say, the US is not prepared to pick up the global slack; US industrial output fell 4.1% in October and 5.5% in November on a YoY basis.

A great deal of the fall in industrial output is related to slow global car sales. However drops of this magnitude show up very quickly in employment income and household income, and thus domestic consumer consumption. In short, the expected result would be slower home sales and reduced spending on construction of consumer and commercial real estate. We are also seeing this, and it is a doubly painful blow coming on the heels of a nearly global property bubble.

For US readers, the most shocking statistic should be November rail freight versus YTD rail freight. YTD total US rail freight volumes fell. Carloads declined 1.4% and intermodal declined 3.5%. That includes November figures - and in November, US carloads fell 10.1% and intermodal declined 7.9%. The world cannot experience what it is experiencing without US producers taking a corresponding hit, and those statistics give us a first read on magnitude.

I see by posts like this that I have not gotten through to people who are well-qualified to understand what I am trying to explain, and therefore I conclude that I have not communicated well. This post is an attempt to remedy that error.

The US is bound for a very long recession that will be the worst since WWII. From peak to trough GDP is likely to contract 5% or so. What you see now on the consumer/business side is not indicative; this recession may be a year old but it is just picking up steam, and the consumer recession will now coincide with the double dip commercial recession beginning in the first quarter 08.

World trade is going to contract next year. There is nearly global overcapacity in most production areas, and worst, the overcapacity is substantial enough to cause the costs of production to rise for many industrial products. The steep falls in the costs of energy are the end of the bubble and the attempt of the global economy to adjust for rising costs of production.

Thus any policies which constrain trade or increase the costs of production are not going to stimulate this or any other economy. Obama's 5 million green jobs are a chimera; they could only come at the cost of 10 million other jobs. Carbon cap and trade schemes are suicidal. Mandates to try to up expensive renewable energy production are suicidal, and yes, that means solar and wind, neither of which are currently competitive on a large scale.

Increased production of energy in the US is probably necessary to limit the trade imbalance, but only if the cost of production of that energy is largely in line with conventional sources. Conservation of energy will pay doubly, but only if it puts money back into the pockets of companies and consumers.

Economic efficiency is all that matters.

In 2009 world trade is going to contract. We just don't know by how much. Here's a gander on some of the key Asian stats:

Japan: November trade stats announced under the headline "Kablooey":

Exports fell 26.7 percent from a year earlier, the Finance Ministry said today in Tokyo. That was more than the 22.3 percent decline estimated by economists and the sharpest since comparable data were made available in 1980.Exports to the US slid 34% YoY. Exports to Europe fell 31%. Exports to China fell 24.5%. Exports to all of Asia fell 26.7%, and exports to Russia and the ME also fell, which is not surprising when you think of property busts, oil prices, and Russia's industrial production contracting 8.7% in November after a minor October rise. Just a few short months ago some "experts" were caroling that the US/EU decline would be compensated by growth in trade with China, and that plus strong Japanese domestic demand (household spending has been declining for over half a year) would keep Japan from taking a major economic fall. The famous decoupling, doncha know.

Of course that was a fallacy because about 1/3rd of Chinese GDP is based on exports, and a hefty chunk of those exports go to the west.

Chinese exports and imports also fell:

The big drop in imports should not surprise anyone; China's housing market is contracting (Jan to Nov housing sales were down 18.8%) and the government's plans to stop more employment cuts in the state-owned enterprises include plans to buy stockpiles of metal, etc from domestic operators. China will try to stimulate its economy, but the corollary is that its imports will drop relative to exports. Trade with India has been one of China's bright spots, but....

We don't have November data for India, but in October exports were down 12% and industrial production declined slightly, and in November excise taxes were down about 15%. The auto business is impacted:

While car and two wheeler sales dropped 24 per cent and 15 per cent y-o-y in November, commercial vehicle (CV) sales slumped 48 per cent.India's housing market is also suffering, and a series of initiatives for smaller mortgages were just announced, mostly in the form of interest rate caps. However, those initiatives make mortgage lending for that category stunningly risky, so I am not sure how much a stimulus will be produced.

Not surprisingly, Malaysian exports dropped in October. Singapore November non-oil exports dropped over 17% on a YoY basis. Thailand's November exports dropped over 18% on a YoY basis.

Indonesia is seeing the weakening too, and the attempt in this article to slot in expectations for 2009 was interesting:

If non-oil exports continue to fall at the same rate as in October until December 2008, then exports for the whole of 2008 will be around $108 billion, still a $15 billion increase over 2007. During the same period, oil and gas exports could reach $29 billion, or a 30 percent increase over last year.I don't know how realistic that assumption is. Aside from the knock-on effect as the weakness diffuses rapidly through Asia (for example, Australia's economy is sure to be further affected in the next few quarters.), the next big global problem will be the situation of European banks.

If the December 2008 level of non-oil exports holds for the next 12 months, then exports in 2009 will be worth $96 billion -- a drop of 10 percent from this year -- while oil and gas exports, because of lower prices, will decline from $29 billion to $22 billion. Total Indonesian exports in 2009 will be around $118 billion -- a decline of 17 percent from the 2008 level.

These projections are based on the assumption that the draconian measures taken by industrialized countries start to show results in the second half of 2009.

The rapid rise in lending to eastern European and some ME economies is going to snap back with a vengeance as the eastern European slump keeps building: Czech industrial output fell 8.7% YoY in October, Hungarian industrial output fell 7.2% YoY in October, and Polish industrial output fell 8.9% in November. These were the stronger eastern European economies. There is not much near-term hope for them; October German industrial output fell 3.8% on a YoY basis, October French industrial output fell 6.9% YoY, October Italian industrial output fell 6.9% YoY, October Spanish industrial output fell 12.8% YoY, European new car sales dropped by 25% in November, and European industrial output declined 5.3% YoY in October.

Needless to say, the US is not prepared to pick up the global slack; US industrial output fell 4.1% in October and 5.5% in November on a YoY basis.

A great deal of the fall in industrial output is related to slow global car sales. However drops of this magnitude show up very quickly in employment income and household income, and thus domestic consumer consumption. In short, the expected result would be slower home sales and reduced spending on construction of consumer and commercial real estate. We are also seeing this, and it is a doubly painful blow coming on the heels of a nearly global property bubble.

For US readers, the most shocking statistic should be November rail freight versus YTD rail freight. YTD total US rail freight volumes fell. Carloads declined 1.4% and intermodal declined 3.5%. That includes November figures - and in November, US carloads fell 10.1% and intermodal declined 7.9%. The world cannot experience what it is experiencing without US producers taking a corresponding hit, and those statistics give us a first read on magnitude.

I see by posts like this that I have not gotten through to people who are well-qualified to understand what I am trying to explain, and therefore I conclude that I have not communicated well. This post is an attempt to remedy that error.

The US is bound for a very long recession that will be the worst since WWII. From peak to trough GDP is likely to contract 5% or so. What you see now on the consumer/business side is not indicative; this recession may be a year old but it is just picking up steam, and the consumer recession will now coincide with the double dip commercial recession beginning in the first quarter 08.

World trade is going to contract next year. There is nearly global overcapacity in most production areas, and worst, the overcapacity is substantial enough to cause the costs of production to rise for many industrial products. The steep falls in the costs of energy are the end of the bubble and the attempt of the global economy to adjust for rising costs of production.

Thus any policies which constrain trade or increase the costs of production are not going to stimulate this or any other economy. Obama's 5 million green jobs are a chimera; they could only come at the cost of 10 million other jobs. Carbon cap and trade schemes are suicidal. Mandates to try to up expensive renewable energy production are suicidal, and yes, that means solar and wind, neither of which are currently competitive on a large scale.

Increased production of energy in the US is probably necessary to limit the trade imbalance, but only if the cost of production of that energy is largely in line with conventional sources. Conservation of energy will pay doubly, but only if it puts money back into the pockets of companies and consumers.

Economic efficiency is all that matters.

Friday, December 19, 2008

Well, Since We Were Discussing Portland

I had to go pick the Chief up at an airport in a snow-sleet storm today. I did not get too stressed out by the process, although I was pretty sure I'd never get back up the driveway. All the way there I kept thanking God that it wasn't happening in SGA, because at least in the north the drivers react by slowing down. In south Georgia, they react to road hazards by speeding up!

A) One of the funniest slow motion multi-car crashes I've ever seen. It's hard to believe anyone would be dumb enough to get out of the vehicle they were driving and try to manually brake!!! Luckily, no one gets hurt, and the tone of resignation struck by one of the passengers would make Marcus Aurelius proud.

B) Portland; a snow storm; a video camera - and history is made. I like the bit where they are yelling warnings from the top of the building. I break out in uncontrollable laughter every time I see this. This is what would happen in south Georgia.

C) Look down the road in this video - the Truck of Damocles is heading your way.

D) Contributed by TimF - this is a truly funny time lapse video, complete with soundtrack, of the Trail of $ Wheel Drive Tears. Few make it through. The few, the proud, the drivers with the sense to drive on the snow and not the slick! There are several close calls, but NO ONE GETS HURT.

A) One of the funniest slow motion multi-car crashes I've ever seen. It's hard to believe anyone would be dumb enough to get out of the vehicle they were driving and try to manually brake!!! Luckily, no one gets hurt, and the tone of resignation struck by one of the passengers would make Marcus Aurelius proud.

B) Portland; a snow storm; a video camera - and history is made. I like the bit where they are yelling warnings from the top of the building. I break out in uncontrollable laughter every time I see this. This is what would happen in south Georgia.

C) Look down the road in this video - the Truck of Damocles is heading your way.

D) Contributed by TimF - this is a truly funny time lapse video, complete with soundtrack, of the Trail of $ Wheel Drive Tears. Few make it through. The few, the proud, the drivers with the sense to drive on the snow and not the slick! There are several close calls, but NO ONE GETS HURT.

Thursday, December 18, 2008

Short Bits

Uh, Christmas cookies. Just finished baking the last of 'em. The bright side of all the Christimas baking is that you lose weight, because you never want to see food again. Ever.

Anyway, before I get to WaPo lunacy, here's a few short bits (so I have time to pack the Christmas boxes!).

Here's a new game - check out the backgrounds of Obama's picks. So far, I only found one who's a socialist. Carol Browner is on the "Committee for A Sustainable World Society" of Socialist International.

So far, the most interesting is Genachowski.

Blair Levin, Sonal Shah, and Julius Genachowski are on the Techology, Innovation and Governmental Reform committee. Genachowski caught my eye because he's had major involvement in fluffy, trendy business. He was part of the group that formed SF bank New Resources. New Resources Bank, judging by this news, is discovering a few harsh facts of life about now. Genachowski was a honcho at IAC, which was one of those wheeling-and-dealing new e-commerce firms. Then he started Rock Creek Ventures, which is a money slurping & burping thingamabob. Genachowski may have been a law school buddy of Obama's. Earlier Genachowski was at FCC, which is one link to Blair Levin. It's all kinda like six degrees of Obama kinship. I looked up Sonal Shah too; she's cycled through the big mob at Goldman Sachs, from there going to Google. It's all very hopey-changey; this looks like the good ideas crew.

I do hope that if official administration positions continue, Genachowski will stop active involvement in the slurping and burping business, because that is very much like writing the vanity book that only lobbyists buy (although they do buy thousands of copies at one time, which cuts down sharply on marketing costs). He's probably quite honest, but believe me people are going to be participating in the slurping and burping bit for less than purely market-oriented reasons. Something about the Peer Network, ya know?

Banking is an interesting thing. It makes you entirely cynical, for the best of reasons. You see where the money goes and how it flows.

Anyway, before I get to WaPo lunacy, here's a few short bits (so I have time to pack the Christmas boxes!).

Here's a new game - check out the backgrounds of Obama's picks. So far, I only found one who's a socialist. Carol Browner is on the "Committee for A Sustainable World Society" of Socialist International.

So far, the most interesting is Genachowski.

Blair Levin, Sonal Shah, and Julius Genachowski are on the Techology, Innovation and Governmental Reform committee. Genachowski caught my eye because he's had major involvement in fluffy, trendy business. He was part of the group that formed SF bank New Resources. New Resources Bank, judging by this news, is discovering a few harsh facts of life about now. Genachowski was a honcho at IAC, which was one of those wheeling-and-dealing new e-commerce firms. Then he started Rock Creek Ventures, which is a money slurping & burping thingamabob. Genachowski may have been a law school buddy of Obama's. Earlier Genachowski was at FCC, which is one link to Blair Levin. It's all kinda like six degrees of Obama kinship. I looked up Sonal Shah too; she's cycled through the big mob at Goldman Sachs, from there going to Google. It's all very hopey-changey; this looks like the good ideas crew.

I do hope that if official administration positions continue, Genachowski will stop active involvement in the slurping and burping business, because that is very much like writing the vanity book that only lobbyists buy (although they do buy thousands of copies at one time, which cuts down sharply on marketing costs). He's probably quite honest, but believe me people are going to be participating in the slurping and burping bit for less than purely market-oriented reasons. Something about the Peer Network, ya know?

Banking is an interesting thing. It makes you entirely cynical, for the best of reasons. You see where the money goes and how it flows.

Wednesday, December 17, 2008

Oil, And The Calvinistic Conscience Problem, Part 1

I don't have a problem with Al Gore being a religious nutcase. He can worship Gaia and wave his carbon offset fetishes all he wants - that's protected by the US Constitution.

I do find it amazing that so many seem to need to walk up and donate when he passes the plate. For what? What do you expect to get out of it? Gore's an old-fashioned southern stump preacher pushing a slightly different doctrine, but I note that he passes the plate just like they do and he lives like the most successful and most hypocritical of the breed.

Perhaps you folks who are falling for this junk need to go to church more and listen to some fire and brimstone sermons. That should allow you to assuage your Calvinistic consciences in a more adaptive manner.

Prominent among the Gorish doctrines is the idea that US gas prices are too low. Too low for what, you ask? Too low to force Americans to adopt more environmentally responsible lives, he answers, as he descends from his jet, climbs into his SUV and drives off to his mansion, escorted by Secret Service vehicles. But that does not ring a skepticism bell in your Calvinistic conscience, which is why I think Americans are acting out some cultural mandate. Even Americans aren't this stupid.

I'll pick on two non-stupid people who I think have strong focuses on duty: Tom Carter at Opinion Forum and Carl at No Oil For Pacifists.

Tom Carter read this WaPo editorial and got all enthused about a federal gas tax hike, quoting from the editorial to explain all of the wonders this will accomplish:

This, of course, is the dilemma of both new fossil fuel fields and alternative energy development: Pumping crude from under Arabian and Iraqi deserts costs under $5/barrel; oil sands/shale, new off-shore drilling, and all renewable sources costs well more. Falling oil prices--or, what is the same thing, increased OPEC production quotas--can wipe-out alternative capital investments at a stroke.

This, I think, is the principal energy market failure, and the sole area where (departing from MaxedOutMama) I support government intervention. Not a gas tax, but perhaps forward government energy purchases to keep energy projects active during periods of falling crude prices. It's better than rooting for the OPEC cartel to cut supply.

I hate to get in the way of all of these bugle calls to duty, honor and self-sufficiency, but let's be honest. If the market cannot absorb the cost of oil at $100 a barrel without the world economy tipping into a recession, then a retraction in the demand for oil and consequently lower prices are not a market failure. Those consequences are instead the effect of the market functioning. The reason that the alternative energy sources will be wiped out is therefore structural reality in the world economy, and raising the cost of oil artificially to compensate will just prolong and/or deepen the disaster.

If you want to dispute the bolded statement above, please explain why the energy prices that collapsed the world economy will be any less damaging if you are using biodiesel. Seriously. I await this explanation with great interest. We know we can produce biodiesel at $95 a barrel. We may be able to eventually do it at around $75 a barrel in reasonably large quantities. Let's be optimistic and say we get it to $65. What's it going to do to our ability to compete and produce goods if the rest of the world is slurping oil up at $38?

Brazil produces ethanol at substantially lower costs than recent gas prices, but the US government imposed a high tariff on Brazilian ethanol to prevent it from beating out US-produced corn ethanol. In 2006, after adding transport costs, etc, Brazilian ethanol should have had a wholesale US price of slightly less than $2.00.

So the effort, all told, in the US of government policy has not been to fuel alternative energy in a cost effective manner - no, it has been mostly a vote-buying mechanism which had unfavorable implications for the many sectors of the US economy. (Background: see the much higher energy efficiency of ethanol in Brazil, and a CARD article.)

Electric vehicles, if we ever decide to start producing enough cost-effective electricity to power such a fleet, are also a possible alternative.

But do we really need to worry about importing oil from Canada? Seriously? The major effect of the current downturn in oil prices is that it will knock out some investment in the oil sands there. To recover start up costs, it's estimated that an assured market cost of over $45 is necessary for most of the planned projects to be built and recover their capital investment cost. This is so far below the cost of biodiesel and US-produced ethanols that it is obviously the better option. Besides, we like the Canucks, we trade with the Canucks, and it is very much in our interest to have a strong, healthy Canuckian population up there, nor does buying oil from the Canucks contribute to any world disaster of which I am aware. So we are subsidizing a few gay parades. Is that going to kill us?

A lot of Canadian oil sand projects were planned. The Saudis really want to let costs drift just below the magic Canuck price line (see Wikipedia article):

Countries like Iran have to be pretty worried about that projected doubling of production from Canada's Athabasca sands by 2014. So, you say, I'm making Carl's point? Well, unless we outright subsidize the Canadian oil sands, raising internal energy prices won't move those projects into production. We could do that, you know. We could tell Canadian producers "Here, chaps, we'll write you a contract guaranteeing 20 years of purchases at $43 per barrel for all you can produce", and let them take that to the bank. It's a better profit margin than US Treasuries right now, so it ought to have considerable value.

But we won't. Doing so would raise questions about why we should subsidize Canadian oil mining when we won't allow it in the US. The US has big oil shale deposits, and the estimate for production runs right around $45 a barrel. Writing such a contract would get those projects in gear, and would greatly stimulate the US economy. Further, oil shale deposits are better suited to diesel production; world demand for diesel is rising far higher than for gasoline, and it is the demand for diesel that is our worst oil sufficiency problem, and the segment of the that problem least addressed by measures such as auto efficiency, electric vehicles, and ethanol.

But we won't. Anyone reading this knows we won't. The US federal government has already blocked the development of those projects when it was outright feasible to do so and when it would have required no federal subsidy. Why are we so psychologically invested in "alternative" energy sources? Why?

We already get more crude oil from our Canuck neighbors than from any other country. EIA report:

Nor can I see why we should worry about imports from Mexico; Canada and Mexico are our neighbors, and we should want them to prosper. The reason we currently buy oil from Saudi Arabia is that it is cheap, but if we were to develop more of our own resources, and if the planned Canadian projects went ahead, I think the US would be in a good position with regard to oil.

We'd be in a better position with regard to oil if we stopped focusing on pie-in-the-sky measures and started focusing on the highly achievable stuff that requires minimal government subsidy. However, that doesn't mean biodiesel, etc, except in the smaller projects. It also doesn't mean much wind power. It means coal or nuclear or both for electricity consumption. When the market cost of oil moves high enough to make electric cars an option, they will come. Until that time, they are wasteful boondoggle; the money spent subsidizing Prius purchases would have been far better spent subsidizing Hyundai purchases. It's energy efficiency that matters. In terms of energy, the political structure in the US is recommending a diet of pure potato chips - and offering to pay for it. The long-term health effects will produce a severely malnourished economy!

There have been only a few oil shocks post WWII, and each has resulted in a global economic downturn. (See Roubini/Setser 2004). Note that the "shock" price they are worrying about is about the average price of the last month. Do we really want to raise total energy costs more than the "shock" price about which Roubini was worrying then? Trying to artificially raise the cost of energy now will just cause worse economic problems, which will further decrease the price of oil, which will cause alternative energy to require even greater subsidies. It's a losing battle.

To consider further, take the example of the Brazilian ethanol industry. It has been a success, but the US does not currently have the capacity to produce ethanol nearly as efficiently as Brazil. Further, the success is limited. The end result of the Brazilian ethanol industry is that about 20% of vehicle miles are powered by ethanol. The trucks and so forth still run on oil.

In part 2, let's take a look at that outstandingly silly WaPo editorial. Even for WaPo, it is hilariously superficial.

I do find it amazing that so many seem to need to walk up and donate when he passes the plate. For what? What do you expect to get out of it? Gore's an old-fashioned southern stump preacher pushing a slightly different doctrine, but I note that he passes the plate just like they do and he lives like the most successful and most hypocritical of the breed.

Perhaps you folks who are falling for this junk need to go to church more and listen to some fire and brimstone sermons. That should allow you to assuage your Calvinistic consciences in a more adaptive manner.

Prominent among the Gorish doctrines is the idea that US gas prices are too low. Too low for what, you ask? Too low to force Americans to adopt more environmentally responsible lives, he answers, as he descends from his jet, climbs into his SUV and drives off to his mansion, escorted by Secret Service vehicles. But that does not ring a skepticism bell in your Calvinistic conscience, which is why I think Americans are acting out some cultural mandate. Even Americans aren't this stupid.

I'll pick on two non-stupid people who I think have strong focuses on duty: Tom Carter at Opinion Forum and Carl at No Oil For Pacifists.

Tom Carter read this WaPo editorial and got all enthused about a federal gas tax hike, quoting from the editorial to explain all of the wonders this will accomplish:

…would stimulate the market for new fuel-efficient cars; defund mischief-making petro-states; and cut carbon emissions. Not only that, it would reduce traffic, curb urban sprawl and, by giving drivers an incentive to drive more slowly, improve highway safety. …

A higher gas tax would buy valuable public goods: national security; a cleaner environment; and safer, less congested streets. No matter what, Americans will have to pay for all of that. Why not do it the simple, straightforward way?

Carl looked at the oil situation mostly accurately, but concluded that federal intervention was necessary to prevent a "market failure".This, of course, is the dilemma of both new fossil fuel fields and alternative energy development: Pumping crude from under Arabian and Iraqi deserts costs under $5/barrel; oil sands/shale, new off-shore drilling, and all renewable sources costs well more. Falling oil prices--or, what is the same thing, increased OPEC production quotas--can wipe-out alternative capital investments at a stroke.

This, I think, is the principal energy market failure, and the sole area where (departing from MaxedOutMama) I support government intervention. Not a gas tax, but perhaps forward government energy purchases to keep energy projects active during periods of falling crude prices. It's better than rooting for the OPEC cartel to cut supply.

I hate to get in the way of all of these bugle calls to duty, honor and self-sufficiency, but let's be honest. If the market cannot absorb the cost of oil at $100 a barrel without the world economy tipping into a recession, then a retraction in the demand for oil and consequently lower prices are not a market failure. Those consequences are instead the effect of the market functioning. The reason that the alternative energy sources will be wiped out is therefore structural reality in the world economy, and raising the cost of oil artificially to compensate will just prolong and/or deepen the disaster.

If you want to dispute the bolded statement above, please explain why the energy prices that collapsed the world economy will be any less damaging if you are using biodiesel. Seriously. I await this explanation with great interest. We know we can produce biodiesel at $95 a barrel. We may be able to eventually do it at around $75 a barrel in reasonably large quantities. Let's be optimistic and say we get it to $65. What's it going to do to our ability to compete and produce goods if the rest of the world is slurping oil up at $38?

Brazil produces ethanol at substantially lower costs than recent gas prices, but the US government imposed a high tariff on Brazilian ethanol to prevent it from beating out US-produced corn ethanol. In 2006, after adding transport costs, etc, Brazilian ethanol should have had a wholesale US price of slightly less than $2.00.

So the effort, all told, in the US of government policy has not been to fuel alternative energy in a cost effective manner - no, it has been mostly a vote-buying mechanism which had unfavorable implications for the many sectors of the US economy. (Background: see the much higher energy efficiency of ethanol in Brazil, and a CARD article.)

Electric vehicles, if we ever decide to start producing enough cost-effective electricity to power such a fleet, are also a possible alternative.

But do we really need to worry about importing oil from Canada? Seriously? The major effect of the current downturn in oil prices is that it will knock out some investment in the oil sands there. To recover start up costs, it's estimated that an assured market cost of over $45 is necessary for most of the planned projects to be built and recover their capital investment cost. This is so far below the cost of biodiesel and US-produced ethanols that it is obviously the better option. Besides, we like the Canucks, we trade with the Canucks, and it is very much in our interest to have a strong, healthy Canuckian population up there, nor does buying oil from the Canucks contribute to any world disaster of which I am aware. So we are subsidizing a few gay parades. Is that going to kill us?

A lot of Canadian oil sand projects were planned. The Saudis really want to let costs drift just below the magic Canuck price line (see Wikipedia article):

Countries like Iran have to be pretty worried about that projected doubling of production from Canada's Athabasca sands by 2014. So, you say, I'm making Carl's point? Well, unless we outright subsidize the Canadian oil sands, raising internal energy prices won't move those projects into production. We could do that, you know. We could tell Canadian producers "Here, chaps, we'll write you a contract guaranteeing 20 years of purchases at $43 per barrel for all you can produce", and let them take that to the bank. It's a better profit margin than US Treasuries right now, so it ought to have considerable value.

But we won't. Doing so would raise questions about why we should subsidize Canadian oil mining when we won't allow it in the US. The US has big oil shale deposits, and the estimate for production runs right around $45 a barrel. Writing such a contract would get those projects in gear, and would greatly stimulate the US economy. Further, oil shale deposits are better suited to diesel production; world demand for diesel is rising far higher than for gasoline, and it is the demand for diesel that is our worst oil sufficiency problem, and the segment of the that problem least addressed by measures such as auto efficiency, electric vehicles, and ethanol.

But we won't. Anyone reading this knows we won't. The US federal government has already blocked the development of those projects when it was outright feasible to do so and when it would have required no federal subsidy. Why are we so psychologically invested in "alternative" energy sources? Why?

We already get more crude oil from our Canuck neighbors than from any other country. EIA report:

| Crude Oil Imports (Top 15 Countries) (Thousand Barrels per Day) | |||||

|---|---|---|---|---|---|

| Country | Oct-08 | Sep-08 | YTD 2008 | Oct-07 | YTD 2007 |

| CANADA | 2,055 | 1,923 | 1,910 | 1,898 | 1,894 |

| SAUDI ARABIA | 1,427 | 1,429 | 1,519 | 1,370 | 1,416 |

| MEXICO | 1,254 | 890 | 1,180 | 1,322 | 1,419 |

| VENEZUELA | 1,014 | 944 | 1,037 | 1,221 | 1,131 |

| NIGERIA | 908 | 508 | 941 | 1,184 | 1,055 |

| IRAQ | 575 | 543 | 652 | 490 | 493 |

| ANGOLA | 527 | 416 | 504 | 342 | 511 |

| BRAZIL | 344 | 197 | 228 | 172 | 173 |

| ALGERIA | 305 | 319 | 312 | 213 | 479 |

| KUWAIT | 235 | 110 | 199 | 150 | 179 |

| ECUADOR | 192 | 227 | 209 | 222 | 202 |

| UNITED KINGDOM | 165 | 92 | 72 | 161 | 108 |

| COLOMBIA | 162 | 142 | 182 | 164 | 134 |

| AZERBAIJAN | 125 | 69 | 73 | 35 | 47 |

| EQUATORIAL GUINEA | 114 | 40 | 70 | 49 | 54 |

Nor can I see why we should worry about imports from Mexico; Canada and Mexico are our neighbors, and we should want them to prosper. The reason we currently buy oil from Saudi Arabia is that it is cheap, but if we were to develop more of our own resources, and if the planned Canadian projects went ahead, I think the US would be in a good position with regard to oil.

We'd be in a better position with regard to oil if we stopped focusing on pie-in-the-sky measures and started focusing on the highly achievable stuff that requires minimal government subsidy. However, that doesn't mean biodiesel, etc, except in the smaller projects. It also doesn't mean much wind power. It means coal or nuclear or both for electricity consumption. When the market cost of oil moves high enough to make electric cars an option, they will come. Until that time, they are wasteful boondoggle; the money spent subsidizing Prius purchases would have been far better spent subsidizing Hyundai purchases. It's energy efficiency that matters. In terms of energy, the political structure in the US is recommending a diet of pure potato chips - and offering to pay for it. The long-term health effects will produce a severely malnourished economy!

There have been only a few oil shocks post WWII, and each has resulted in a global economic downturn. (See Roubini/Setser 2004). Note that the "shock" price they are worrying about is about the average price of the last month. Do we really want to raise total energy costs more than the "shock" price about which Roubini was worrying then? Trying to artificially raise the cost of energy now will just cause worse economic problems, which will further decrease the price of oil, which will cause alternative energy to require even greater subsidies. It's a losing battle.

To consider further, take the example of the Brazilian ethanol industry. It has been a success, but the US does not currently have the capacity to produce ethanol nearly as efficiently as Brazil. Further, the success is limited. The end result of the Brazilian ethanol industry is that about 20% of vehicle miles are powered by ethanol. The trucks and so forth still run on oil.

In part 2, let's take a look at that outstandingly silly WaPo editorial. Even for WaPo, it is hilariously superficial.

Deutsche Bank Passes On Bond Redemption

This is not a huge surprise to me, but it is shaking up European markets noticeably:

Earlier in 08, an Italian bank passed, which caused some stress at the time. However Deutsche Bank is a giant, and this will cause a readjustment in market expectations in Europe. Deutsche Bank took some significant losses this year. In the first quarter, it moved to a net loss after writing down 4.2 billion in assets and securities. In the second quarter Deutsche Bank did better, which brought it to a pre-tax nominal first half quarter profit of 0.4 billion.

Speculation is running rampant that DB will report a fourth-quarter loss on write-downs and trading losses.

This failure to redeem those bonds is a big deal.

Deutsche Bank AG, Europe’s biggest investment bank by revenue, passed up an opportunity to redeem 1 billion euros ($1.4 billion) of subordinated bonds, saying it would be more expensive to refinance the debt.On Jan 16th, the bonds step up to Euribor plus 88 basis points (0.88%). It is a rare event indeed for a bank to pass a call date (early redemption) on its bonds. The reason is that passing such a date will automatically raise all your future borrowing costs for a time, because the bonds out there usually lose some of their market value.

Earlier in 08, an Italian bank passed, which caused some stress at the time. However Deutsche Bank is a giant, and this will cause a readjustment in market expectations in Europe. Deutsche Bank took some significant losses this year. In the first quarter, it moved to a net loss after writing down 4.2 billion in assets and securities. In the second quarter Deutsche Bank did better, which brought it to a pre-tax nominal first half quarter profit of 0.4 billion.

Speculation is running rampant that DB will report a fourth-quarter loss on write-downs and trading losses.

This failure to redeem those bonds is a big deal.

Friday, December 12, 2008

Anatomy Of A Rather Severe Recession

Take a look at this:

The base data is available from here. The graph shows the YoY time series for US retail sales (total) for August, September, October and November since 1997.

You should be able to click on the graph to see a larger version.

That fan arrangement shows a sharp negative and steepening trend. A lot of this is motor vehicles, but in November most spending categories are well down, with food, drugstores and general stores (read WalMart) being up YoY. In other words, McDonald's and WalMart are doing well, grocery stores are still pressured, and the larger and more discretionary the spending category, the more likely it is to drop.

In terms of YoY USD changes (the figures I am citing are retail sales by month, adjusted for seasonal and trading days, but not for inflation), on a YoY basis retail sales in November showed a drop of 28.4 million dollars. This is actually not as bad as it looks, because in part we are still seeing the effect of this summer's energy prices. Due to high costs, some consumers that normally pay on a budget basis much earlier in the cycle didn't, and so now spending is being impacted. That pulse will wear off in about 3-4 months.

However consumers compensated in part for stagnant incomes and recently, soaring inflation, with credit. Some of this was in revolving credit, and some was in the form of shifting short-term debt into home loans (MEW). Trends in revolving credit (this release by the FRB does NOT include RE-secured revolving):

There is almost always a good correlation between the Q3 rate of growth and Q4's. So consumers aren't going to be charging up a storm. (The 04 hump represents MEW-induced improvements.)

However, see M1. In the last 3 months, M1 has grown 36.9%. In non-bankerese, M1 is the money supply as measured by currency outside of banks, traveler's checks, demand deposits and other transaction accounts (such as NOWs). It does not include savings, which is measured by M2 and has grown only 13.8% in the last three months.

There is some cash out there; how much of it is in consumers' hands is the question. My guess is that a lot of it is sitting in the hands of the financial conservatives. They may give it away to charities, they may eventually buy stuff they need, they may use it to help out family and friends who are in a pinch, but they aren't suddenly going to go out and buy big-ticket items out of an abundance of high spirits.

The last bit of data is that current consumer sentiment is improving, surprising, apparently, all economists. The rest of the country knows why - the drop in gas prices is allowing people to improve their day-to-day finances. But six-month outlook is negative, which supports my contention that people will spend less until they feel more secure.

There are other positives that should start to pay off aside from energy. One is the fact that old-fashioned adjustable rate mortgages, and even most HELOCs, are resetting to lower interest rates. This helps the consumer picture a little. Producer prices are crashing (finished goods YoY fell from 8.2% in Sept to 0.4% in November). Import prices are falling (the YoY change for November was -4.4%).

The negatives are very negative indeed. Unemployment is rising rapidly:

That will be somewhat mitigated by extended unemployment and by older people taking early retirement, but still, that unemployment rise correlates to expected drops in consumer spending, and so do basic population demographics. The over-16 employment/population ratio is in part the function of an aging workforce:

Next up, we'll look at the 2007 Consumer Expenditure tables to see where we can get some money back for additional spending. It appears we need to find about 10 mil a month, and it's going to be hard to find that just lying around!

Oh - I forgot. US rail freight for November:

U.S. railroads originated 1,189,472 carloads of freight in November 2008, down 133,504 carloads (10.1 percent) from November 2007. U.S. railroads also originated 851,517 intermodal units in November 2008, a decrease of 72,978 trailers and containers (7.9 percent) from November 2007, the Association of American Railroads (AAR) reported today.Once we get the lightbulbs moving, that'll clear up right quickly.

One Big Lie

If you aren't following the Madoff story, you should begin to. This is not going to charge the Street with holiday spirits. It probably will spawn an outbreak of drinking to excess.

A bunch of his clients were hedge funds. Of course, when you are paying clients with money from other clients, you can (for a while) deliver much higher returns than the market warrants. Bloomberg's got a good article:

It sounds like they moved in to prevent the money from being distributed. This guy's a big name.

The reason I think everyone should follow this story is that one of the constant suggestions to "fix" the financial crisis is to remove mark-to-market. OK, that's what this guy basically did.

Any time you aren't marking to market, you are misrepresenting current value and cooking the books. Furthermore, making this legal would greatly reduce confidence between banks and financial firms. If you don't know what their current holdings are really worth, how can you know whether you are doing business with someone who can pay you back? Cash flow is not a reliable indicator for financial firms - relying on cash flow is exactly what Madoff did.

Turning the entire industry into a ponzi scheme isn't going to solve anything.

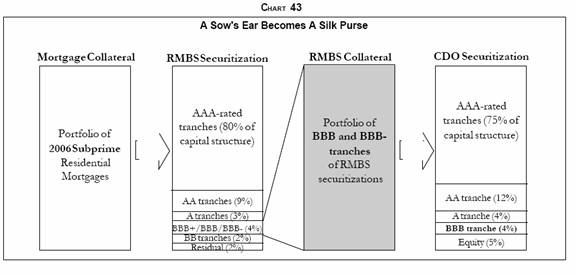

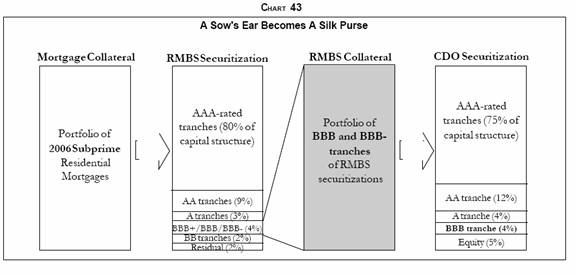

Update: Okay, Jimmy J is still arguing with me about mark-to-market. But his arguments seem to be based on ignoring the tranching system that created the certainty of high losses on some investment types when a coordinated economic downturn developed. See this Mauldin article about the problem, and here's a chart:

Thus, a very small shift in expected payout ratios on a pool of mortgages that spawned this chain of securities can be expected to deliver whopping default ratios to the securities at the end of the line. As Mauldin observed:

And of course the market is illiquid. During the run up, the B tranches were greatly beloved of some dipshit hedgies who weren't gutsy enough to buy the insurance company disaster bonds. Because of the payment structures, those low-grade tranches actually paid out large and rapid returns in a time of rapid prepayments (such as those delivered by house flippers and loans resetting to much higher payments within 2-3 years, thus triggering a refinance). It is those large returns that hedgies must have in order to justify the 2 and 20. As soon as the music stopped, those same tranches were toxic waste. It is true that the market is now illiquid, but that is because these investments are Rube Goldberg machines engineered to be very sensitive to risk and loss. If loss and risk is low, they pay off handsomely. If loss and risk is median, they suck and become illiquid unless you can find someone stupid to buy them. ( In the innovative world of structured finance, that means buy 'em up, pool them, and re-tranche.) If loss and risk moves higher, they splat.

In short, I don't want to hear any more nonsense about mark-to-market being the problem. That's as if I go to the doctor, the doctor finds a lump in my breast and sends me for a biopsy, and I refuse to go and instead sue the doctor for pain and distress. The messenger is not the friggin' problem.

A bunch of his clients were hedge funds. Of course, when you are paying clients with money from other clients, you can (for a while) deliver much higher returns than the market warrants. Bloomberg's got a good article:

While meeting the pair at his home yesterday, Madoff conceded that he was “finished,” that his advisory business is “all just one big lie” and “basically, a giant Ponzi scheme,” the government said. The business had been insolvent for years with losses of about $50 billion, he told the employees, according to the criminal and SEC complaints.He's obviously got some ethics. I guess we'll find out more about the structure of the scheme later, in court. It sounds like he didn't start out intending to commit fraud, but backed into it thinking he was covering a cash flow shortfall.

Madoff said he had about $200 million to $300 million left and planned to distribute money to select employees, family and friends before surrendering to authorities in about a week, the government said.

It sounds like they moved in to prevent the money from being distributed. This guy's a big name.

The reason I think everyone should follow this story is that one of the constant suggestions to "fix" the financial crisis is to remove mark-to-market. OK, that's what this guy basically did.

Any time you aren't marking to market, you are misrepresenting current value and cooking the books. Furthermore, making this legal would greatly reduce confidence between banks and financial firms. If you don't know what their current holdings are really worth, how can you know whether you are doing business with someone who can pay you back? Cash flow is not a reliable indicator for financial firms - relying on cash flow is exactly what Madoff did.

Turning the entire industry into a ponzi scheme isn't going to solve anything.

Update: Okay, Jimmy J is still arguing with me about mark-to-market. But his arguments seem to be based on ignoring the tranching system that created the certainty of high losses on some investment types when a coordinated economic downturn developed. See this Mauldin article about the problem, and here's a chart:

Thus, a very small shift in expected payout ratios on a pool of mortgages that spawned this chain of securities can be expected to deliver whopping default ratios to the securities at the end of the line. As Mauldin observed:

That means that if those RMBS lose just 5% of their value, everything but the AAA portion of the CDO is wiped out. Any losses beyond that start eating into the value of what a rating agency said was AAA! If the Greenwich projections are right (and these are very serious analysts), then all 2006-vintage CDO's will lose their AAA rating when the rating agencies look at them again.Guess what happened? Pool losses on a lot of "innovative" mortgages are already exceeding 20%; naturally the end-of-the-line securities saw their valuations drop like a stone.

And of course the market is illiquid. During the run up, the B tranches were greatly beloved of some dipshit hedgies who weren't gutsy enough to buy the insurance company disaster bonds. Because of the payment structures, those low-grade tranches actually paid out large and rapid returns in a time of rapid prepayments (such as those delivered by house flippers and loans resetting to much higher payments within 2-3 years, thus triggering a refinance). It is those large returns that hedgies must have in order to justify the 2 and 20. As soon as the music stopped, those same tranches were toxic waste. It is true that the market is now illiquid, but that is because these investments are Rube Goldberg machines engineered to be very sensitive to risk and loss. If loss and risk is low, they pay off handsomely. If loss and risk is median, they suck and become illiquid unless you can find someone stupid to buy them. ( In the innovative world of structured finance, that means buy 'em up, pool them, and re-tranche.) If loss and risk moves higher, they splat.

In short, I don't want to hear any more nonsense about mark-to-market being the problem. That's as if I go to the doctor, the doctor finds a lump in my breast and sends me for a biopsy, and I refuse to go and instead sue the doctor for pain and distress. The messenger is not the friggin' problem.

Caution: Northern Delaware Flooding

I just looked at the weather service gauges, and I think those folks have been caught napping.

I'm up in the NE, and it's been pouring. I heard the creek rise last night. This morning I went to look at a couple of streams and the Delaware, and it looks ugly.

In northern Mercer County there are huge chunks of debris floating down the river, and they are really booking along. In the space of about ten minutes I counted several boats, what looked to be a chunk of dock or a piece of a house, massive trees, and massive tree stumps. Water level was rising after nine this morning about a foot an hour judging by creek backup.

I don't see the normal alerts. If you know someone who lives in the northern Delaware River basin, you might want to call and warn them. The Delaware River is really only dangerous at 50 year intervals, but we are still at the tail end of one of those 50-year intervals. During that time, it can and does flash flood, and when it does, the local tributaries flash too. The ground in parts of PA and NJ is just saturated from a combination of freezing/rain cycles.

Hopefully this will not be as bad as it looks right now, but I went and looked at a riverside hill, and the amount of runoff about six hours after the major rain had ended was sinister.

You folks a little further down have some time....

I'm up in the NE, and it's been pouring. I heard the creek rise last night. This morning I went to look at a couple of streams and the Delaware, and it looks ugly.

In northern Mercer County there are huge chunks of debris floating down the river, and they are really booking along. In the space of about ten minutes I counted several boats, what looked to be a chunk of dock or a piece of a house, massive trees, and massive tree stumps. Water level was rising after nine this morning about a foot an hour judging by creek backup.

I don't see the normal alerts. If you know someone who lives in the northern Delaware River basin, you might want to call and warn them. The Delaware River is really only dangerous at 50 year intervals, but we are still at the tail end of one of those 50-year intervals. During that time, it can and does flash flood, and when it does, the local tributaries flash too. The ground in parts of PA and NJ is just saturated from a combination of freezing/rain cycles.

Hopefully this will not be as bad as it looks right now, but I went and looked at a riverside hill, and the amount of runoff about six hours after the major rain had ended was sinister.

You folks a little further down have some time....

Wednesday, December 10, 2008

Adages Abound?

OK, ok, economics is depressing me. A moment for some philosophizing:

So this guy's living with the perfect woman:

There are a few minor problems aside from the not-gettin'-any aspect of the relationship. The inventor's in debt up to his ears, is living with his brother, has no job, and had a heart attack at the age of 33. How much good is it for your "perfect woman" to know 13,000 different sentences in various languages if she doesn't know when to curtail her conversation to "You need to go to the doctor!"

Also, I have to believe that most average, decidedly imperfect women are capable of far more than 13,000 sentences. There's all sorts of variations along the lines of:

"The neighbors have a better [car/boat/house/lawn/mailbox/pool~] than we do", and

"Honey, buy me a [fill in the blank].

See, that's the problem. Your average woman is irritating and wants to sleep sometimes, but you get sex and generally you last longer. I can't quite imagine any of the guys I know including the "no-sex" bit in their definition of the perfect woman. Granted that plenty of men have ended up broken, in debt and basically run over in their pursuit of the perfect woman. It's proverbial. The thing is, in general they were thinking that they would get a roll in the hay out of it, and many times they actually did before going bust and being discarded like last year's Ken doll.

Now, before I found out that the inventor didn't have the sex tweak done yet, I was thinking that Sharper Image didn't really have to go bankrupt. I'm guessing this would be a hot seller, with you know, a few enhancements.

But watch Gizmodo.com - they've always got the best and the newest! Their version of the perfect woman will

include sex! Just look what they've done with the old tried-and-true get her a puppy gift idea! That's outstanding! You definitely couldn't land in the dog house for that gift!

Does anyone else want to see the BigDog go after Aiko? Wouldn't that be great? Download the video (beware, the BigDog looks like a mutant outerspace insectoid BEM from hell) and just imagine Aiko running along in front of that thing, screaming.

Puts a smile on my face just thinking about it. Maybe DARPA will be able to save us from the perfect women. This post and story really ought to be up at Exurban Nation, but disappointingly, Rob is confining himself to pointing out nasty economic truths.

So this guy's living with the perfect woman:

“She doesn’t need holidays, food or rest and she will work almost 24-hours a day. She is the perfect woman,” he said.He built her himself:

Le, a scientific genius from Brampton in Ontario, Canada, said he never had time to find a real partner so he designed one using the latest technology.But no sex:

He said he did not build Aiko as a sexual partner, but said she could be tweaked to become one.Try a gentle rubbing rather than a "tweak".

There are a few minor problems aside from the not-gettin'-any aspect of the relationship. The inventor's in debt up to his ears, is living with his brother, has no job, and had a heart attack at the age of 33. How much good is it for your "perfect woman" to know 13,000 different sentences in various languages if she doesn't know when to curtail her conversation to "You need to go to the doctor!"

Also, I have to believe that most average, decidedly imperfect women are capable of far more than 13,000 sentences. There's all sorts of variations along the lines of:

"The neighbors have a better [car/boat/house/lawn/mailbox/pool~] than we do", and

"Honey, buy me a [fill in the blank].

See, that's the problem. Your average woman is irritating and wants to sleep sometimes, but you get sex and generally you last longer. I can't quite imagine any of the guys I know including the "no-sex" bit in their definition of the perfect woman. Granted that plenty of men have ended up broken, in debt and basically run over in their pursuit of the perfect woman. It's proverbial. The thing is, in general they were thinking that they would get a roll in the hay out of it, and many times they actually did before going bust and being discarded like last year's Ken doll.